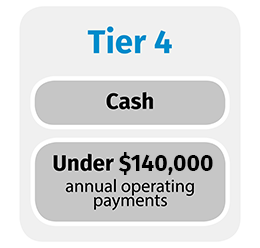

Tier 4

Resources and information to help charities with the Tier 4 standard. This includes the Annual Reporting Guide for Tier 4 charities, the Get started videos, and links to download the Standard, template and guidance notes.

Charities with annual operating payments under $140,000 that do not have public accountability(external link) can choose to use the Tier 4 Standard. Refer to Which tier will I use? for more information about the tiers.

How to complete your performance report and annual return

This resource is intended to help Tier 4 charities complete their performance report and submit their annual return.Find out more

Simple Tier 4 Reporting Template

The External Reporting Board have created an optional simpler template for small tier 4 charities. This is intended for very small charities who do not engage in any complicated transactions, and do not need to disclose any additional information. The template is available in other languages.Find out more

Tier 4 annual reporting resources and templates

Here you will find Tier 4 annual reporting guidance, a webinar that guides you through the performance report, performance report templates to download and other resources.Find out more

How to use the Tier 4 Excel template

This tutorial will help you use the Tier 4 performance report template in Excel. You can watch the tutorial as a series of short videos or read the written version below. It will take 20 minutes to watch the whole tutorial.Find out more

Tier 4 example performance reports

On this page, you'll find Tier 4 example performance reports to help you prepare your own. Some of the examples were completed in 2016, soon after the new reporting standards were implemented. Therefore, some may not include comparative information to their previous financial year. To comply with the financial reporting standards, your performance report must include comparative information to your previous financial year, also called the ‘Last Year’ column in the template.Find out more

Tier 4 reporting webinars

Here you will find a number of different webinars to support you in completing both your performance report and annual return.Find out more

Tier 4 minimum categories

The Tier 4 performance report sets out minimum categories that must be used in preparation of the Statement of Receipts and Payments and Statement of Resources and Commitments.Find out more

Tier 4 member and non-member receipts

In the Statement of Receipts and Payments, money received from members is to be recorded separately to money received from non-members.Find out more

Related party transactions for Tier 3 and Tier 4 charities

The Tier 3 and Tier 4 financial reporting standards require charities to report related party transactions. Related party transactions are recorded in the Notes section of the performance report.Find out more

Does your Tier 4 charity control another or other organisations?

Control for financial reporting purposes is defined as when an entity controls another entity when the entity is exposed, or has rights, to variable benefits from its involvement with the other entity and has the ability to affect the nature or amount of those benefits through its power over the other entity. Tier 4 charities in this situation may need to include information about these organisations by providing a consolidated performance report.Find out more