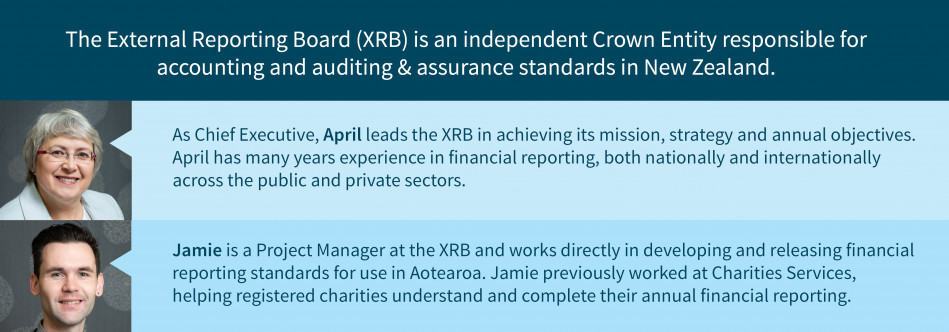

How COVID-19 may affect your audit report

Published 5 June 2020

[![]() 5 minutes to read]

5 minutes to read]

Understandably, many of us are anxious about what the future holds for ourselves and the organisations we work or volunteer for. Auditors face the same challenges, which means that some audit reports may look different to what you are used to.

The uncertainty organisations face can significantly affect their performance reports and/or financial statements. Similarly, physical distancing measures have made it difficult or in some cases impossible for auditors to access the information they need to as part of an audit.

Clean vs modified reports

You might have heard of an audit report being “clean”, but what does that actually mean? It means that the auditor has found satisfactory answers to all their questions about the financial statements. It also means that from these answers, the auditor can form an opinion that the financial statements have been prepared in the way described in the financial reporting standards and it’s unlikely (but not impossible) they contain significant errors. This type of report is called an “unmodified” report and is what most people will be used to seeing.

Unfortunately, in the current climate it’s going to be more difficult for auditors to answer their questions. If the auditor can’t answer some of their questions or forms the opinion that what is being reported is incorrect in some way, they are likely to “modify” the report.

Most often this will take the form of a “qualified” report. These are given where the auditor has not been able to answer questions about something specific, or is of the opinion that something is incorrectly reported. Another way to think about this is that the report is clean other than the specific thing described.

Less common are “adverse” and “disclaimer” reports. Adverse reports are given where an auditor has answered all their questions but is of the opinion that the financial statements as a whole are misleading. Disclaimer reports, on the other hand, are given where the auditor has been unable to answer enough of their questions to form any opinion on the financial statements at all.

If an audit report is “modified” an auditor is required to explain why in the report. It’s important that you read those to fully understand the opinion. Audit reports are modified for many reasons and some are more serious than others.

Here are some examples of modifications that you may expect to see over the coming months. With all of these modifications, if you are a funder, or deciding whether to donate to an organisation, it’s worth having a look at the previous year’s financials to see if there have been past issues that might hint at more ongoing issues with the modification in question.

Examples

- Inventory – Auditors will usually attend year-end stock takes to assess the value of inventory reported by an organisation. With travel restrictions in place, many auditors will not have been able to attend these. They may need to perform other procedures, or give the charity a modified opinion.

- Internal controls – Auditors test the controls an organisation has in place to aid in the assessment of the figures reported in the financial statements. For example, a charity having a process to ensure that an end-of-month reconciliation (checking your finance system against what came into your bank account) is approved by two people. Many organisations have had to change the way they are working, and their controls may not all have been in operation or may be operated differently. In some cases, an auditor may not have anything else to base their assessment on and will have to modify the report, although in most cases this won’t be serious.

- Asset value – Some organisations have assets which are valued based on market forces or how much cash they are expected to bring in (e.g. fair value of buildings). Given the uncertainty right now, auditors may not be able to assess whether judgements made by an organisation on valuation are appropriate. Although this sounds concerning, it doesn’t necessarily mean the auditor thinks the organisation is wrong in their judgement. It may only reflect that no one knows with enough certainty what is going to happen over the next 12 months.

What else should you look out for in an audit report?

Even without a “modification”, you can understand more about the financial statements by reading the audit report. Some of the terms are a bit complex, so I am going to explain a few that you are likely to see.

Key audit matters and emphasis of matter

Auditors use the “key audit matters” section of their report to explain what they thought was most important while carrying out their audit, why they thought it was important, and where in the financial statements you should look so you can consider these things for yourself. For example, you might see a paragraph around the valuation of Property, Plant and Equipment and state where further information is in the Notes to the Financial Statements.

An “emphasis of matter” is similar, with one important difference: it only directs the reader to an important part of the financial statements and does not describe why the auditor thought it was important. For example, if there was a fire that occurred after year end, there would be a sentence highlighting this specific Note in the Financial Statements to the reader.

Material uncertainty related to going concern

For many organisations it’s going to be unclear whether they can continue operating. For example, not-for-profits may not know whether their donations will fall, or whether they will continue to receive grant funding they depend on.

In cases like this you will often see a “material uncertainty related to going concern” paragraph. These are used when the auditor agrees with an organisation’s assessment that it’s a going concern (i.e. it will continue to be able to operate) but also need to tell the reader the organisation is uncertain about that. These paragraphs, will identify the part of the financial statements or performance report that relates to the uncertainty.

This might not be a significant concern for many charities that rely on uncertain funding like donations, for others it might mean they are unable to continue.

What does the future hold?

There will be more modifications to audit reports and more matters reported as we all work our way through the impacts of the pandemic. Be sure to carefully read audit reports to understand what the auditor is trying to tell you. If you are reading your own organisation’s report, we recommend asking your auditor to explain anything you are not sure of.

For more information on what an audit or review means check out this earlier blog(external link).

If you read something that you don’t understand in a performance report or financial statement, you can contact a charity by looking at its contact information on the Charities Register(external link). You can also let Charities Services know by emailing info@charities.govt.nz. One of our people will get in contact.